Alphabet, the parent company of Google, announced a 20-for-1 stock split along with its quarterly earnings report on Feb. 1. It’s only the second split for the stock since it went public in 2004; a 2-for-1 split in 2014 created the company’s Class C shares in the process. But the new split is especially conspicuous because of the eye-popping split ratio.

Issuing investors 19 additional shares for every share held would based on today’s closing price, lower Alphabet’s stock price from $2,700 per share to less than $150. The shares rose more than 9% on the news in after-hours trading, when they topped a price of $3,000.

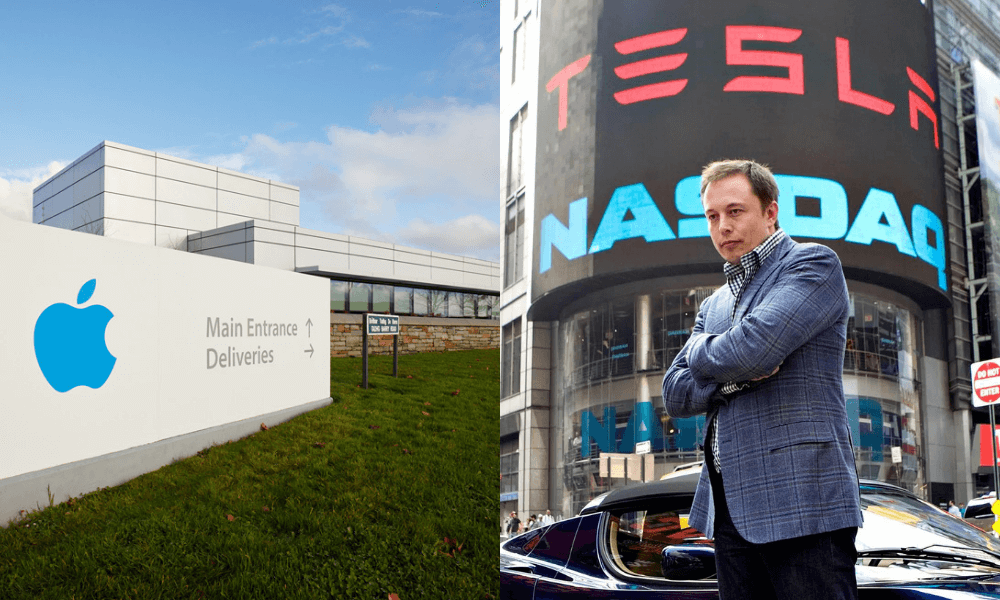

The 20-for-1 split outdoes recent stock splits from Apple and Tesla, which split 4-for-1 and 5-for-1 respectively on the same day in August 2020. The graphics chip maker Nvidia, another tech stock popular with retail investors, split 4-for-1 in July 2021.

What is a stock split?

Stock splits lower the price of a stock—in Alphabet’s case to one-twentieth of its price—possibly making it more attractive to retail investors. Since the start of the covid-19 pandemic, Wall Street has seen a massive influx of retail traders. At the same time, tech stocks like Alphabet, Apple, Tesla, and Nvidia have all risen precipitously, fueled by low-interest rates and high demand for their products. Alphabet shares have doubled in price since March 2020.

Massive stock-split ratios like Alphabet’s are rare but not unprecedented. In 1957, Getty Oil planned a 20-for-1 stock split. More recently, Amalgamated Bank did a 20-for-1 split in 2018, and the ad tech firm The Trade Desk executed a 10-for-1 split in June 2021.