Euro-area consumer prices jumped 5.1% from a year ago in January

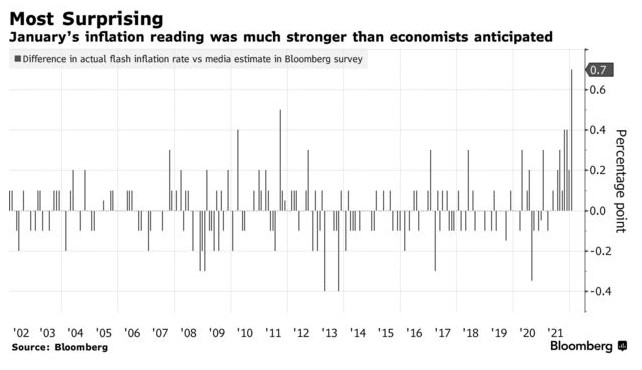

Euro-area inflation unexpectedly accelerated to a record, overshooting expectations by the most in at least two decades and fueling bets the European Central Bank could raise interest rates earlier than expected.

Consumer prices jumped 5.1% from a year ago in January, up from 5% in December. The median estimate in a Bloomberg poll of 44 economists saw a reading of only 4.4% and none predicted inflation gaining pace.

Money markets now see the ECB lifting rates by 10 basis points by July, rather than by September. The euro extended its advance, climbing 0.4% against the dollar to $1.1315.

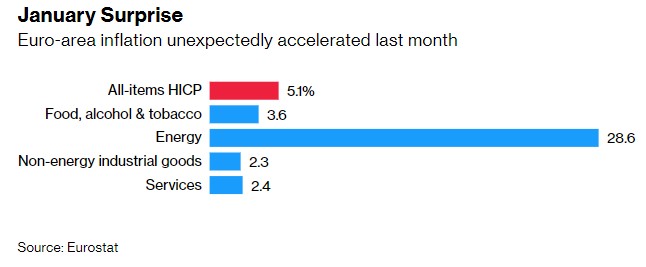

While slowing in Germany and France, the euro zone’s two biggest economies, the spike in energy costs pulled price growth higher across the 19-member currency bloc as a whole. It was more than a percentage point higher than analysts predicted in Italy, where it accelerated to 5.3%.

Stripping out energy and other volatile components like food, core inflation was 2.3%, down from last month’s 2.6% reading.

Wednesday’s data come as ECB officials gather to discuss monetary policy against a backdrop of increasingly aggressive tightening by the Federal Reserve and with the Bank of England primed to lift interest rates for the second month in three.

While the ECB, which has an inflation target of 2%, has pledged to end crisis-era bond-buying, it’s doing so more slowly. President Christine Lagarde has said repeatedly that elevated price growth will pass as electricity and heating costs ease and the supply-chain snarls that have restrained factories abate.

Lagarde now faces pressure similar to that which prompted other central bankers to abandon their insistence that the current bout of inflationary pressure is temporary.

Fed Chair Jerome Powell said in December that it was “probably a good time” to retire the word ‘transitory.’ The ECB and Lagarde will face “tough questions” at her news conference on Thursday, according to Piet Christiansen, the chief strategist at Danske Bank.

“We expect projections will be revised higher in the March round, which will be important for the calibration of the monetary-policy outlook, and there’s a risk of Lagarde wanting to buy time for the new projections,” he said. “The next meeting is only 5 weeks away.”

Some governments have stepped in to help households struggling with the soaring cost of energy, which shot up by 28.6% in January across the 19-member currency bloc. There are also signs that supply disruptions are becoming less acute, while the statistical effect of a temporary sales tax cut in Germany is also disappearing, helping to bring down headline inflation there.

Strong demand, however, is allowing companies to push higher costs for parts and materials onto customers, according to a survey of purchasing managers released this week, threatening to keep stoking prices in the coming months.

Traders have ramped up bets on a rate hike - contradicting ECB policymakers who say that’s unlikely. Money markets now see a quarter-percentage point of increases by year-end, which would take the deposit rate to minus 0.25%.

ECB officials say they’ll change their stance if necessary but point to forecasts suggesting inflation will be below their 2% goal in 2023 and 2024. Most economists surveyed by Bloomberg last month agreed that price growth is likely to settle below the target next year, predicting the first rate increase in September 2023.

Wage growth will be the key factor in the medium term. While policymakers don’t see cause for concern so far, euro-area unemployment has fallen -adding to upward pressure on salaries. (Source)