Apple Inc. (AAPL.O) is overcoming a costly global shortage of computer processors, reporting record holiday quarter sales, smashing profit forecasts, and predicting that its gap will reduce.

According to analysts, the iPhone maker, which has the world's most significant market capitalization, has handled supply-chain problems, including plant shutdowns and shipment delays caused by the pandemic, better than any of its top competitors. Apple shares recovered around 5% in after-hours trading, erasing half of their year's losses. The increases occurred after the business highlighted its plans for metaverse augmented reality.

Almost the holiday quarter, more customers wanted iPhones, iPads, and other gadgets than Apple had to offer, losing the company over $6 billion in sales, or precisely what it had predicted. On the other hand, which is many part suppliers' largest customer, Apple leveraged its purchasing clout to compel those manufacturers to ship enough devices to fuel record sales in the iPhone, Mac, and wearables and accessories divisions. According to Apple insiders, Chip shortages are primarily hurting older models of the company's devices and have impacted iPad sales in particular.

"They've negotiated the supply chain better than everyone else, and it's showing in the results," said Ryan Reith, an analyst at IDC who monitors the smartphone market. According to Apple, the four best-selling phones in urban China were all iPhone models, while competitors struggled to produce competing products. Counterpoint Research revealed that it was the top-selling vendor in China for the first time in six years.

According to Nicole Peng of research firm Canalys, a successful quarter was driven by comparatively low prices and the exit of crucial rival Huawei from the market. According to Peng, Apple's quarterly performance was influenced by one-time circumstances; thus, the company is unlikely to replicate it this year. She did say, though, that if Chinese consumers warm up to a new iPhone SE, which is likely to be unveiled this year, the business might still have a strong 2022.

Apple's successful service subscription sales, including music, TV, and fitness, are also helping cushion the pain of low device supply. The business announced that it now had 785 million paying users across at least seven subscription offers, up 40 million from the previous quarter and assuaging investor concerns about slowing growth at competitors such as Netflix Inc.

Even better, Apple Chief Financial Officer Luca Maestri told Reuters that easing chip shortages could result in a revenue loss of less than $6 billion this quarter. However, he declined to make any further projections in the future.

"The degree of constraint will be largely determined by other companies, as well as the demand for chips from other companies and industries," he explained.

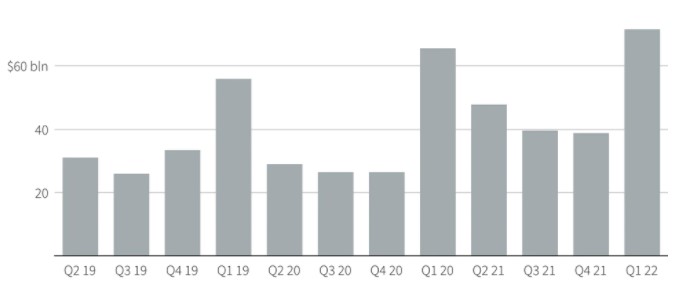

Apple's iPhones dodge supply nightmare

Company reports record sales for 2021 holiday quarter

Source: Company press releases (Reuters Graph)

According to Refinitiv statistics, the iPhone 13, which began delivering days before the quarter began, resulted in worldwide phone sales revenue of $71.6 billion for Apple, a 9% rise from the 2020 Christmas season and well ahead of Wall Street expectations. The increase in sales was linked to a record number of upgrades from earlier iPhones and double-digit increases in individuals transferring from competitors, according to Maestri.

Apple's overall fiscal first-quarter sales was $123.9 billion, up 11% from the previous year and more than the $118.7 billion predicted by analysts. Profit was $34.6 billion, or $2.10 per share, compared to $31 billion and $1.89 per share expected by experts.

However, Maestri warned that sales growth may drop in the current quarter compared to the previous quarter, owing to lower foreign exchange rates and differing product launch dates.

iPads were Apple's lone product category that fell short of expectations in terms of sales. Sales decreased 14% to $7.25 billion, vs analyst expectations of $8.2 billion, confirming industry concerns that the tablets would be given poor priority for any rare parts.

Services, Apple's second-largest business after iPhones, had a 24% increase in sales to $19.5 billion. Apple's revenue from Mac computers increased by 25%, and the last six quarters were the best for Mac sales in the company's history.

The pandemic has hastened the adoption of digital communication, learning, and entertainment technologies, propelling Apple to record-breaking sales in the previous two years.

However, investors have been transferring capital this year toward safer assets and away from tech firms like Apple, which have gained as people spend more time online as a result of the pandemic.

The time it will take Apple to produce its next big product, such as the augmented reality (AR) headset for the metaverse, has been questioned by Wall Street. On Thursday, Chief Executive Tim Cook told investors, "We see a lot of potential in this market and are investing accordingly."

Apple is also under antitrust scrutiny in the United States and Europe, which might result in new restrictions that reduce its revenue from services. After finding that Apple had abused its market dominance by requiring dating app developers to exclusively use Apple's in-app payment system, the Dutch Authority for Consumers and Markets (ACM) ordered Apple to make changes for apps available in the Apple App Store in the Netherlands by Jan. 15 or face fines.

Nonetheless, Apple is valued at 27 times next year's estimated earnings. According to Refinitiv, it is still over the company's five-year average of 20 times projected earnings, while being down from a high of 35 a year ago.