The Fed will signal a move in March to the markets: Evans on State Street.

As they aim to contain the highest inflation in nearly 40 years, Federal Reserve policymakers are expected to announce their first interest rate hike since 2018 and discuss decreasing their bloated balance sheet.

Following a two-day policy meeting on Wednesday, the Federal Open Market Committee is expected to keep its benchmark rate near zero, while adhering to its plan to reduce asset purchases and end them in March.

At 2:00 p.m. in Washington, the committee will issue a statement, followed by a 30-minute press conference by Chairman Jerome Powell. This meeting does not have any published projections.

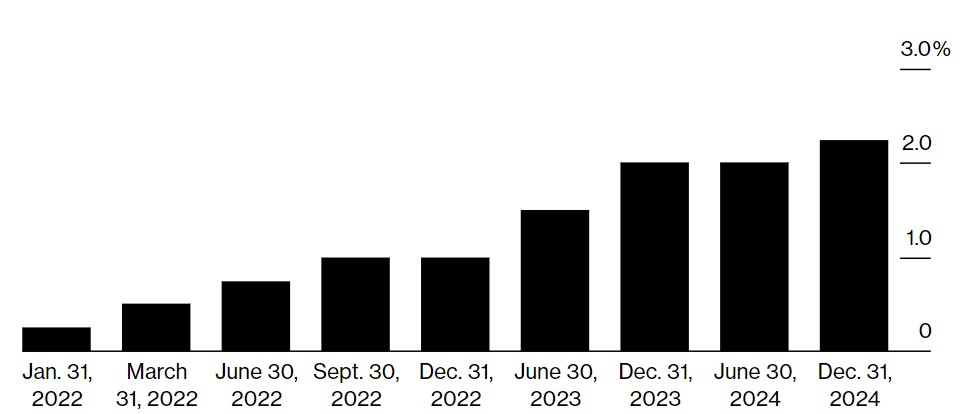

Higher Interest Rates are on the Way

The Fed is expected to raise rates in March, and rates may rise gradually in 2023.

Source: Bloomberg poll of economists, 14-19 January 2022.

With the unemployment rate in the United States falling below 4% last month, the FOMC is likely to declare that the economy is at or near full employment and that the first step toward higher interest rates may be warranted shortly, possibly at the March 15-16 meeting.

In their December "dot plot," policymakers pencilled three rate rises for 2022, and several Fed members favoured a March move.

"The January conference is primarily about talking — about providing market players with a framework to comprehend how they would use both conventional and unconventional policy tools. They'll make a rate announcement and let you know when they'll have a runoff strategy in place. They despise market surprises," said Vincent Reinhart, chief economist of Dreyfus and Mellon and a former head of the Federal Reserve's monetary affairs section.

Tapering Strategy

AS POWELL STATED IN HIS CONGRESSIONAL TESTIMONY, the FOMC is expected to conclude asset purchases in March, though other economists believe the committee may consider ending bond purchases sooner.

"It would be a surprise if they cut quantitative easing in February rather than March," said Thomas Costerg, senior US economist at Pictet Wealth Management. "However, in hindsight, it would be only half a surprise, and it would even make sense, given the overwhelming consensus" that stimulus is no longer required.

Statement of the Federal Open Market Committee (FOMC)

The statement is anticipated to declare that the labour market in the United States has continued to make progress toward the Fed's employment goals and that this, along with above-trend inflation, suggests that accommodation will be removed soon. With a mention of "next meeting" implying the rate decision is all but made, the particular phrasing will give some sense of the level of commitment to March.

"There should be a very explicit hint in the announcement that a rate hike is coming shortly," MacroPolicy Perspectives founder Julia Coronado said.

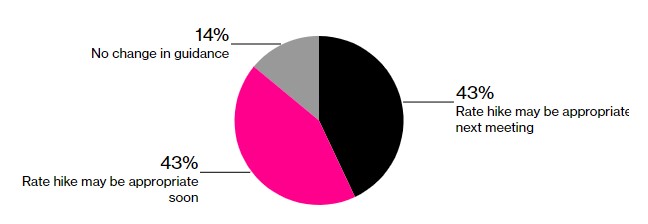

Changes in Guidance

The majority of analysts believe the FOMC statement will imply a rate hike at the next meeting or soon after.

Source: Bloomberg News survey of economists Jan. 14-19

Despite calls for the Fed to raise rates by 50 basis points in March, the majority of economists polled by Bloomberg do not believe this is likely. In a Bloomberg Television interview on Jan. 13, Fed Governor Christopher Waller advocated against such a step, though he didn't rule it out in the future if required.

While the omicron variety has caused some softening in recent economic data due to more workers being sick, the FOMC may choose to ignore this and restate that economic and labour market conditions remain good.

According to Deutsche Bank AG economists, the statement might be altered to eliminate the Fed's instruction that it will use the "full range of measures" to wind down the balance sheet later this year, indicating that asset purchases will soon be off the table.

Framework for Monetary Policy

The FOMC has approved a statement on longer-run goals and strategy at its January meetings in recent years, which is changed in August 2020 to underline its full-employment aim by asking for broad-based and inclusive improvements. Despite the fact that the plan has been challenged, it is expected that the framework will be confirmed with no revisions, as it did in January 2021.

A press conference was held

Powell is sure to be challenged on the Fed's plans for normalizing policy, but with Covid-19 still wreaking havoc on the labour market, among other dangers, he may want to tread carefully. He'll almost certainly be questioned on the Fed's plans to reduce its $8.87 trillion balance sheet, which the FOMC is scheduled to debate further at this meeting.

Powell has stated that the procedure will most likely begin later this year. Bloomberg polled economists who believe the runoff of maturing securities will start in September.

"I don't expect much clarity from Chair Powell," said Gus Faucher, PNC Financial Services Group's senior economist. "Omicron is still out there, and they want to keep some flexibility" in their balance sheet plans, according to the source.

The chair is sure to face repeated questioning about the current rate of inflation, which is at its highest level since 1982 at 7%. While Fed officials have attributed the majority of the price increase to supply interruptions related to Covid, notably the latest omicron variety, they were mistaken in their earlier predictions that the price increase would not last.